The role of a Quantity Surveyor is essential in ensuring construction projects stay on budget and on schedule. A Quantity Surveyor is essentially responsible for the reporting of a project’s cost from start to end. They will often provide cost reports at various stages of construction to a number of parties involved in the Construction project.

So what is a quantity surveyor, why are they important and what can they do for you?!

What is a Quantity Surveyor?

A Quantity Surveyor is a professional who specializes in managing costs and finances for construction projects. They work closely with architects, engineers, contractors, and other professionals to ensure that projects are completed within budget and on time.

Quantity surveyors are responsible for estimating costs, preparing budgets, negotiating contracts, and monitoring expenses throughout the construction process. They also provide advice on cost-effective solutions and help to resolve any financial disputes that may arise.

Importance of a Quantity Surveyor in the Construction Industry

Quantity surveyors are essential to the construction industry as they play a crucial role in managing costs and ensuring projects are completed within budget. They are responsible for estimating and monitoring project costs, preparing tender documents, negotiating contracts, and managing financial risks.

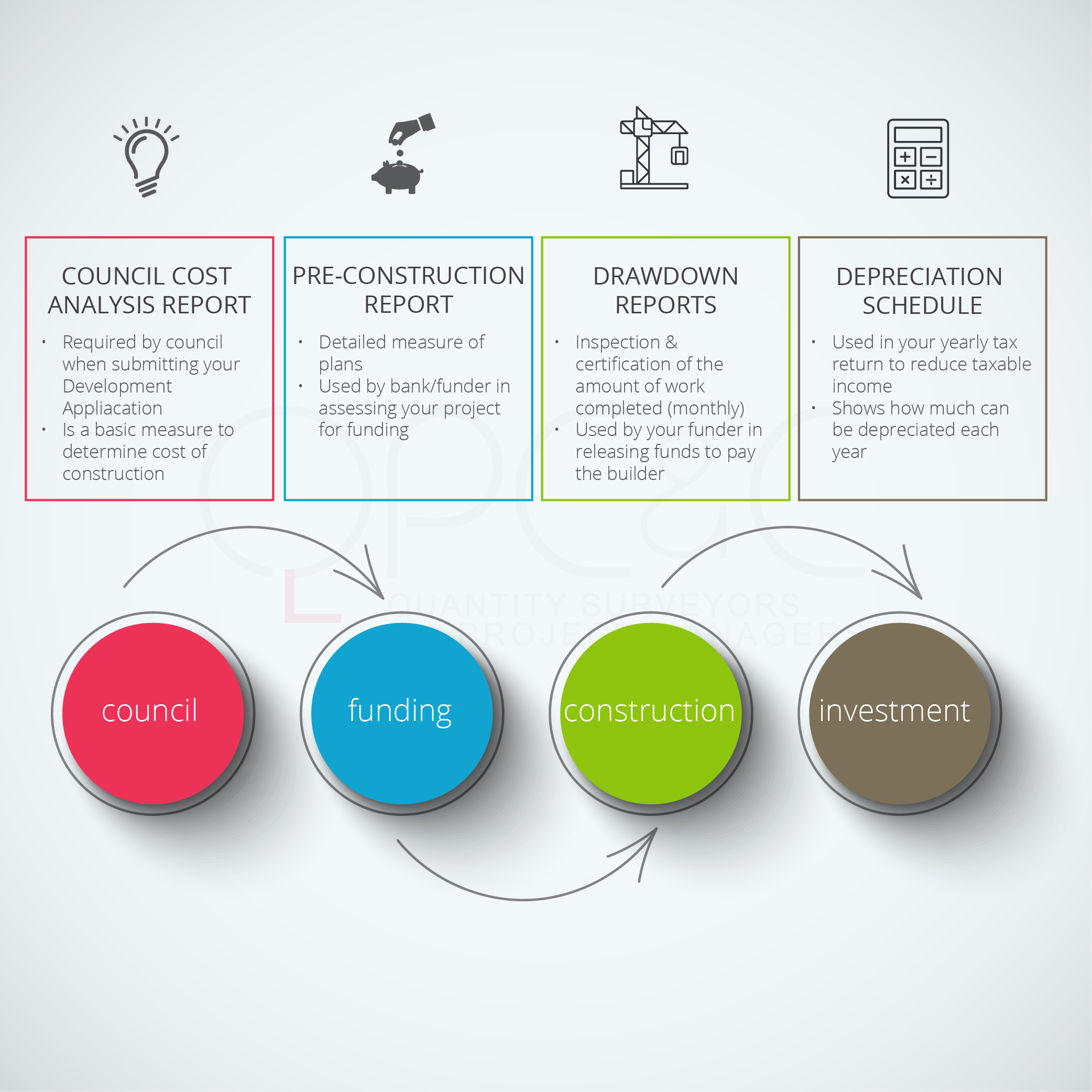

There are 4 main reports that a Quantity Surveyor will provide, based on the stages of the project life cycle; Council, Funding, Construction and Investment.

If you’re looking for a little more in-depth, click through each stage of the project cycle below.

Council’s across NSW require a Registered Surveyor’s Detailed for all projects where the cost of construction exceeds a certain value. This value varies between councils, but is typically where the cost of construction exceeds $500,000.

Council requires this report to reflect the project construction cost, firstly as an indication as to what is being built in their council area, as well as determining Section 94 Contribution Fees to be paid by the developer.

This report shows an elemental cost analysis breakdown, which is done via measuring off the DA Architectural Plans and does not include measurement of additional service drawings.

When seeking a construction loan from a financier or bank for your development, they will generally require a Pre-Construction Report. This report contains a full bill on quantities which shows a breakdown of costs by trade, and is measured in more detail than a council cost report.

The financier will use this report to determine if the project is financially viable and if they will provide a construction loan to the applicant. Essentially, the funder wants to reduce their risk, so they are doing their due diligence by having a report which breaks down all associated costs with the project. This report details the total cost of construction to verify how much the construction loan should be for.

During Construction Drawdown Reports or Progress Claims Reports are required to be obtained from a Quantity Surveyor. Progress reports are required by the funder to certify the value of works completed, in order for them to drawdown on the loan.

A Quantity Surveyor will inspect the project to determine the value of works complete to date, or since the previous progress claim, and then provides a report certifying and documenting the works completed for this claim. The financier then relies on this report to determine how much work has been completed and then will accordingly drawdown on the loan and advance the certified amount of money to pay the builder.

The Quantity Surveyor is here minimising the risk for the bank, by certifying how much work has been completed. They also document projected cash flow and the projected time of completion of the work, as well as any key issues that the funder may have flagged. The funder need to be aware of these items to understand if they need to make provisions for additional interest or funds in the loan.

It is often recommended to use the same Quantity Surveying Firm that were comissioned to provide the inital reporting for the funding stage.

Depreciation schedules are generally for investment properties, and occur in the post-construction period of a project. A Depreciation schedule is used to determine the amount that can be claimed in a tax return based on the depreciable asset(s).

Each depreciable asset is different, and a house (unit, villa etc.) is comprised of the exterior, as well as various items throughout the property. Each component of the property has a different life span and value for which it can be depreciated over. These items are detailed in a depreciation schedule report which can then be used by your tax agent as a part of your yearly return.